North Star Investments (BD) Limited was previously known as Asian Tiger Capital Partners Investments Limited.

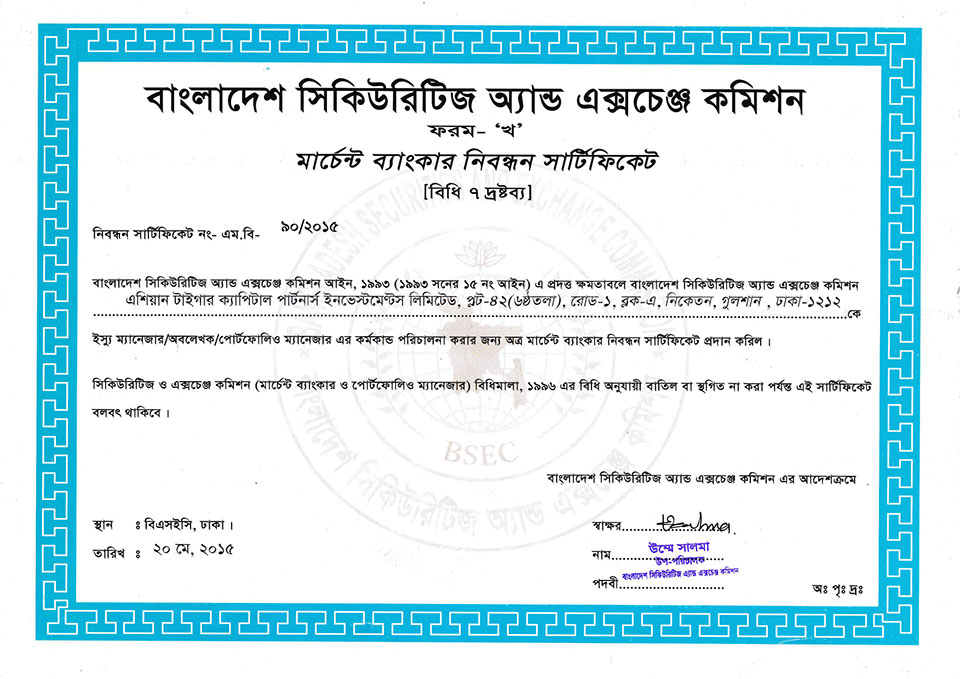

Asian Tiger Capital Partners Investments Limited received its full-fledged merchant banking license, No. MB-90/2015, from the Bangladesh Securities and Exchange Commission, on May 20, 2015.

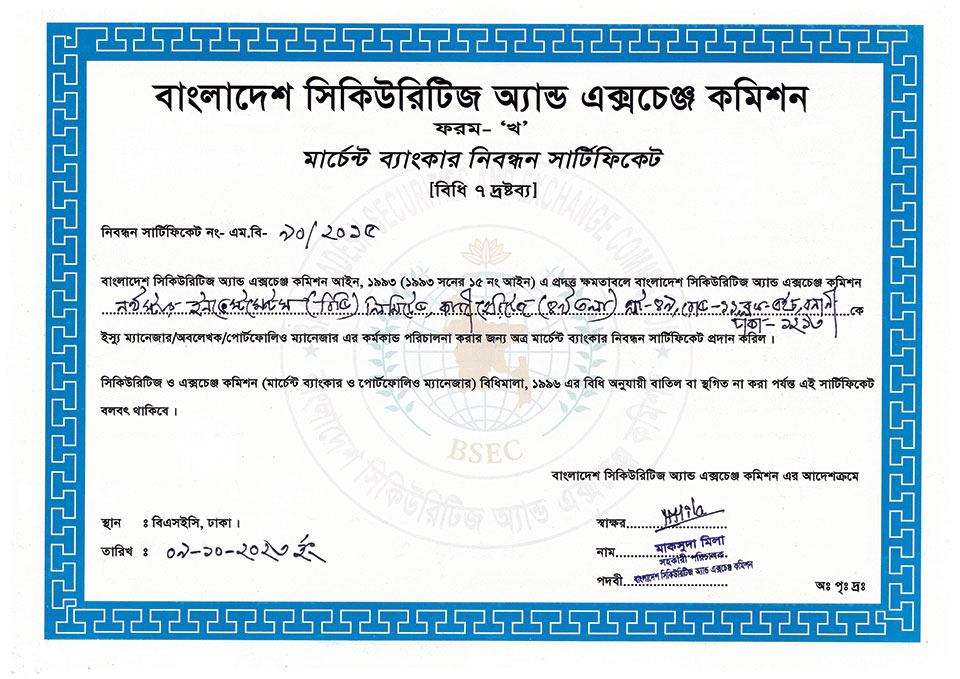

Upon BSEC regulatory approval of the change of name of Asian Tiger Capital Partners Investments Limited to North Star Investments (BD) Limited, vide letter BSEC/Reg/MB-109/2023/455, dated October 9, 2023, the full-fledged merchant banking license Certificate was re-issued with registration No. MB-90/2015 (the same as held previously).

Previous Certificate Copy

Re-issued Certificate Copy

RJSC name change approval Copy

ASIAN TIGER CAPITAL PARTNERS INVESTMENT (ATCP INV)

Asian Tiger Capital Partners Investments received its full-fledged Merchant Banker license, No. MB-90/2015, from the Bangladesh Securities and Exchange Commission, on May 20, 2015.

The license allows the company to expand its decade old corporate advisory services, including mergers and acquisitions, strategic advisory, valuation, and debt syndications, to the capital markets, where new services, such as issue management of companies for public listing, repeat offerings and rights issues, underwriting of public offerings, and portfolio management and margin lending are offered.

ATCPIL are a team of investment professionals lead by its active directors and senior management who have extensive experience in the domestic and foreign corporate sectors in advising and managing capital market related services. The senior management is supported by a team of analysts and associates, along with finance, operations and compliance teams.

We follow a thorough and structured market read for strategic and or capital markets advisory, based on top down macro-economic, market and sector research in parallel with company specific bottom up research, company management interviews and fundamental analysis. The overall capabilities of our senior management include more than fifteen public offerings, several mergers and acquisitions, and over twenty debt syndications over the past three decades.

ASIAN TIGER CAPITAL PARTNERS

Asian Tiger Capital Partners, the flagship company of AT Capital group has been offering, since its inception, high-value consulting and corporate advisory services to various enterprises in Bangladesh ranging from Government of Bangladesh (e.g. Ministry of Finance, PPP cell etc.) to multi-lateral donor agencies, (eg. Asian Development Bank, Islamic Development Bank, International Finance Corporation, etc.) to high profile multinational and local corporate houses.

Projects undertaken by this Company include services for Policy Issues and Regulatory Framework (for GOB), consulting services for framing various policies and support programs for multilateral organizations (e.g. Capital Market Development Program of ADB) and finally various types of corporate advisory services including numerous sector-specific studies for the private corporate & MNC clients (e.g. Textiles & Clothing, Pharmaceuticals, Telecommunications, Banking & NBFI, Consumer Goods and FMCG, and Agriculture). This Company also carries out macro-economic research and equity research for its international clients on a regular basis.

Our differentiated service offering is our global advisory, research and investment team and our access to leading market participants. ATC has extensive links with both the public and private sector and has been closely involved in the capital markets as the lead advisor to the Bangladesh Association of Publicly Listed Companies (BAPLC). It worked on a detailed report on the Stock market crash and prospective regulatory reforms as well as more detailed analysis of reforms in areas such as the book building rules.

It has also produced a number of research reports for the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) including a 100 page Bangladesh in 2015 strategic outlook. ATC also has wide-ranging relationships with many of the leading of the banks, NBFIs, and other key financial sector stakeholders. It also has developed a broad range of relationships with foreign institutional investors in both the capital markets and FDI.

Someone's sitting in the shade today because someone planted a tree a long time ago.

Warren Buffet